Absorption Costing explained including an example

Contents:

This can lead to inflated unit costs and, ultimately, higher prices. This could make your products less competitive in the marketplace and result in lower sales. It also enables them to price their products more competitively within their market. However, to make sound pricing decisions, it is essential to understand all the costs involved in production.

- Therefore they have to be distributed to cost centers on some sharing basic like floor areas, machine hours, number of staff, etc.

- This is likely to be based on an annual overhead budget for manufacturing and then divided by certain factors, for example, how long a machine is expected to run to produce the product in question.

- This method is usually applied in cases where labor is the main factor in production.

You just need an idea about what areas need better management so your company can grow. Calculate gross profit by subtracting the cost of goods sold from sales. Since we have introduced cost behavior into the course, we know that overhead can be either variable or fixed . An example of Absorption Costing is provided to illustrate how this method works in practice. Ultimately, it is up to each business owner to decide if Absorption Costing is the proper method for their company.

Accounting Details

For each department we look at, we need to decide whether they are labour intensive or machine intensive. We work out an overhead absorption rate, and once we’ve got that we’ve got a nice simple mechanism to help us work out the estimated full production cost per unit for our products. Traditional absorption costing was initially designed to help production businesses deal with their production overheads. In particular, what a business would like to do is work out the cost of the products it is producing. Now, when doing this, it’s very easy to estimate the direct costs of production.

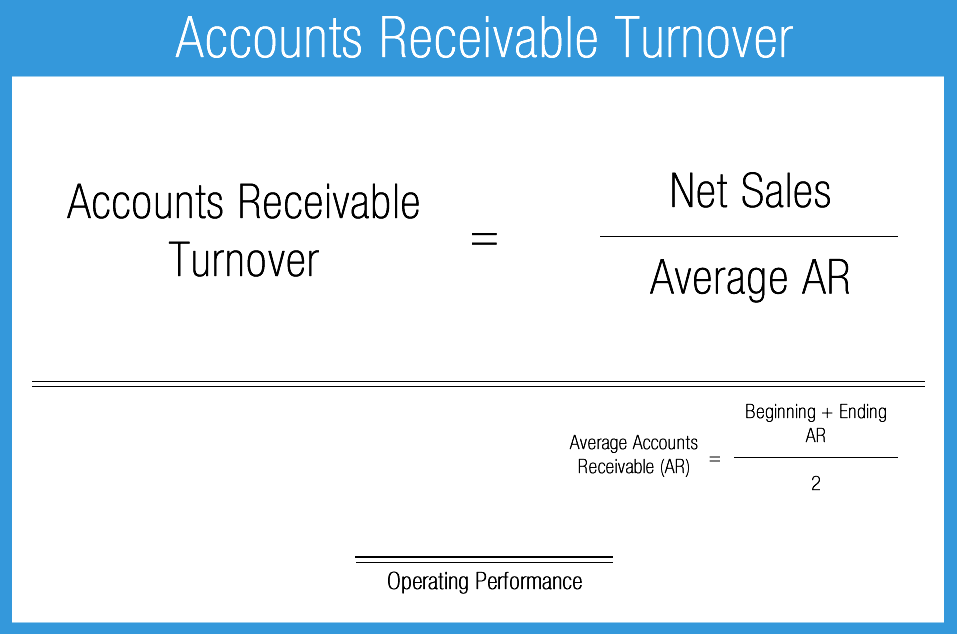

bench accounting absorption is defined as the allotment of overheads to cost units. When the amount of overheads has been determined on the predetermined basis for each cost center, the next step is to charge it to production. General or common overhead costs like rent, heating, electricity are incurred as a whole item by the company are called Fixed Manufacturing Overhead. Fixed Cost FormulaFixed Cost refers to the cost or expense that is not affected by any decrease or increase in the number of units produced or sold over a short-term horizon. It is the type of cost which is not dependent on the business activity.

Ideal for Use in Privately Held Companies- Benefits of Using Absorption Costing

Once you have the unit cost, the rest of the statement if fairly straight forward. Allocate overhead by dividing the fixed overhead by the number of units. Despite these drawbacks, Absorption Costing is still a popular way to measure production costs. When used correctly, it may be an important tool for any business seeking to stay competitive in today’s market. This guide will discuss absorption costing, how to use it, alternatives, and the benefits of doing so.

The cost of the materials that you use to manufacture your product is therefore the basis of charging overhead to your product units. To work out the percentage of direct material costs, you need to divide the total overhead cost by the total cost of the materials used. The way that fixed overhead expenses are handled is what distinguishes absorption costing from variable costing. When using absorption pricing, fixed overhead expenses are distributed proportionately across all units produced throughout the time. It’s a very simple approach to absorb overheads into cost units; very simple in that it’s not overly detailed, it’s not overly complex.

Percentage of Direct Labor Cost

Absorption costing and variable costing are two different methods of costing that are used to calculate the cost of a product or service. While both methods are used to calculate the cost of a product, they differ in the types of costs that are included and the purposes for which they are used. The differences between absorption costing and variable costing lie in how fixed overhead costs are treated. Absorption costing is a method of allocating manufacturing overhead costs to inventory.

If you like, at the moment what we have in our production overhead cost accounting for department A is $5,000 too high. So, what we’d have to do is just make a slight adjustment to our management accounts to make sure we account for that over absorption. We’re already told that the expected direct material cost is $12 per unit, and the labour cost is $14 per unit.

Absorbing Overheads

The https://1investing.in/ costs may include direct labor cost, direct material cost and all the expenses that vary if the number of products varies. A company’s profit level can appear higher than it is in a given accounting period due to cost through absorption costing. This is because revenues are not affected by fixed costs unless all manufactured products are sold. To calculate under absorption, take the total cost of goods sold and subtract the variable costs. To calculate absorption costing, take the total cost of goods sold and add the fixed costs.

As we have discussed, the markup over cost ideally should be largely determined by market conditions. However a particular approach is to at least start with markup based on cost and desired profit. The markup must be large enough to cover sales, general and Administrative (SG&A) expenses and provide an adequate return on investment . Even overhead expenditures that can’t be directly traced to the product are charged against each unit.

The goal of explaining manufacturing standard cost absorption variances is to help the audience understand why there may be differences between the actual costs incurred and the predetermined costs. By understanding the variances, decision-makers can take steps to improve operations and control costs. Favorable manufacturing absorption variances typically indicate that a company is efficient in its production process and can produce goods at a lower cost than was initially budgeted.

Let us understand the reasons for which the absorption costing method is used and preferred for external reporting. The absorption costing method is useful as it considers the fixed cost while determining the cost of units produced. If the fixed overhead charges are not taken into consideration, then there are chances that the fixed cost will not be fully covered or can remain under-absorbed. In the absorption costing method, the fixed manufacturing cost is shown as expenses only when goods are sold.

Calculations using fixed costs provide a lower net income than those using variable costing do as a consequence of this. But with absorption costing, this measure includes all of the costs that go into the manufacturing of a product. And accurate accounting is essential in ensuring a proper balance sheet and income statement. But some businesses also use this accounting trick to increase profitability temporarily. Then, check your expense activity to determine the exact amount you spent on production costs.

First Formula Keto Gummies Reviews: Best Keto Gummies For Weight Loss – Outlook India

First Formula Keto Gummies Reviews: Best Keto Gummies For Weight Loss.

Posted: Mon, 20 Mar 2023 07:00:00 GMT [source]

Machine hour rate is calculated by dividing the factory overhead by machine hours. Looking at the above mentioned example, Absorption Costing could be required to determine the overhead costs of the enterprise. The more items one plant can produce, the lower the costs will be of these items, especially the overhead costs. If the factory starts producing other items or products, it is possible to spread and reduce the overhead costs even further. On the other hand, adjusting overhead absorption rates or fringe benefit accrual rates following standard practice does not constitute a change in accounting. Instead, this kind of modification involves making adjustments to projections, which are then implemented prospectively.

It is best suited to those units of production where overheads depend on both direct materials and direct labor. We know that both direct materials and direct labor determine the nature of overheads. The prime cost, comprising direct materials, direct labor, and direct expenses, is significant in every type of organization. Variable overhead costs directly relating to individual cost centers such as supervision and indirect materials. You need to allocate all of this variable overhead cost to the cost center that is directly involved. This method is mostly used if the industry is labour-intensive and the labour is mostly unskilled or semiskilled.